San Francisco Bay Area Housing and Rental Market 2025: Tech Layoffs vs. AI Boom

The San Francisco Bay Area housing market in 2025 tells a fascinating story of two opposing forces — the continued wave of tech layoffs and the explosive rise of the AI industry. While traditional tech sectors have shed thousands of jobs, AI companies are rapidly expanding, reshaping both the housing and rental landscapes across the region.

Overview: A Market of Contrasts

The Bay Area’s housing and rental trends in 2025 reflect deep regional divides.

- San Francisco city has emerged as a clear winner, showing resilience and even growth amid broader economic uncertainty.

- Meanwhile, other Bay Area submarkets — particularly Silicon Valley and parts of the East Bay — are seeing cooling demand, higher inventory, and more buyer-friendly conditions.

The result: a bifurcated real estate market, where proximity to AI-driven innovation increasingly determines housing demand.

Home Sales and Price Movements

San Francisco defied the broader regional slowdown in 2025.

- Home sales rose 5% from January to July 2025 compared to the same period in 2024 (from 2,870 to 3,010 transactions).[1]

- In contrast, the wider Bay Area saw a 2% decline in total sales.

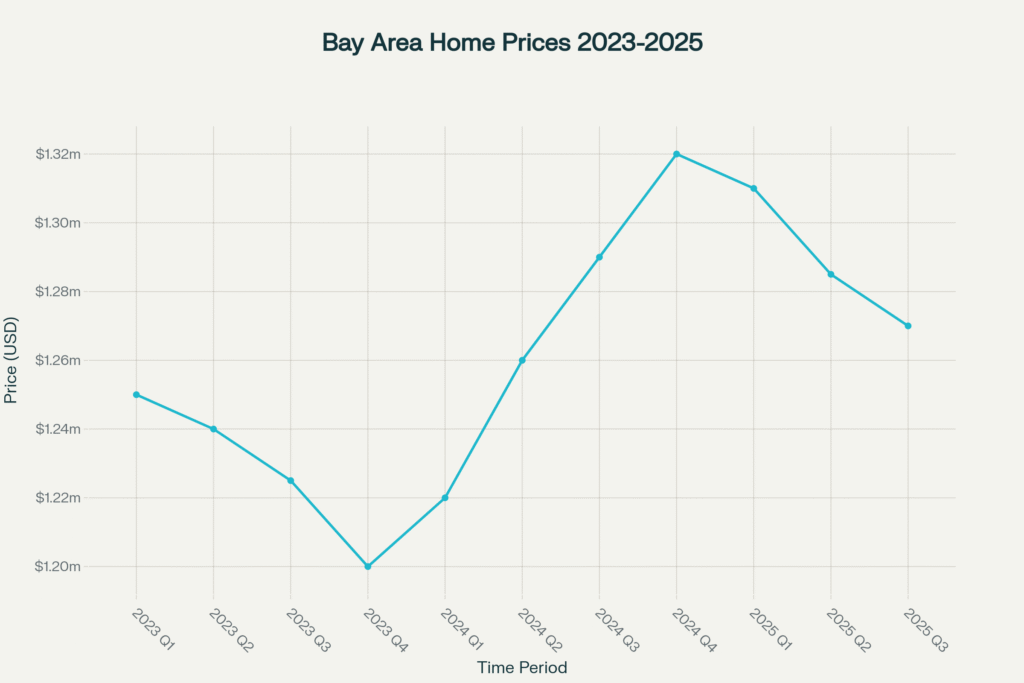

Median home values in San Francisco climbed over 5% year-over-year, reaching around $1.27 million as of August 2025.[3][4] While this is a slight 1% dip from 2024’s peak, it underscores the city’s enduring strength.

By comparison:

- 2023: Market correction, median price ~$1.20M

- 2024: Strong rebound, median price ~$1.32M (+5.2%)

- 2025: Cooling, median ~$1.27M by fall

Luxury homes continue to outperform, with $3.5M+ properties up 40% since 2023 — a trend led by high-earning professionals in AI and venture capital sectors.[5]

Inventory and Market Balance

Inventory tells the clearest story of divergence:

- San Francisco: Listings continue to shrink — single-family homes down 2.54%, condos down 14.01%.[6]

- East Bay: Inventories up 31.4%.

- Silicon Valley: Supply rising across the board — single-family homes up 21.6%, condos up 34.8%.[7]

With just 1.8 months of supply for single-family homes, San Francisco remains firmly a seller’s market, unlike its neighboring regions.[7]

Rental Market: The AI-Driven Rebound

If the for-sale market looks steady, the rental market is booming — particularly in San Francisco.

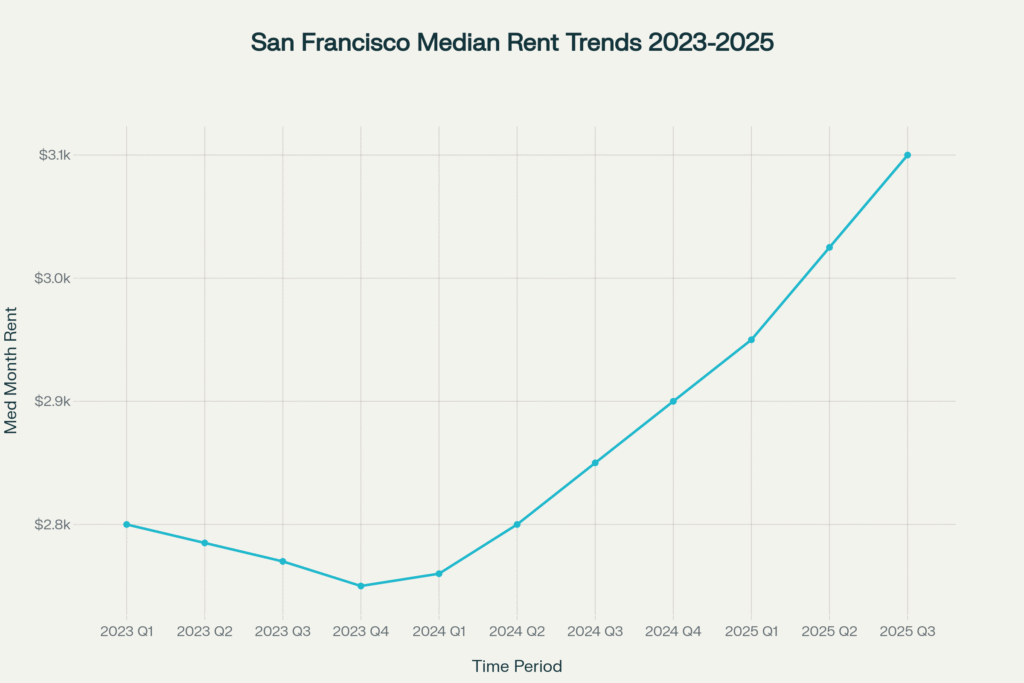

- Median rent for a 1-bedroom: ~$3,100 in September 2025 (+12% YoY)

- Vacancy rate: Down to 3.8%, compared to 4.4% in 2024

- Time to lease: Now just over 3 weeks, down from 4+ weeks last year[8]

This sharp rebound marks San Francisco as the fastest-growing rental market in the U.S., even as national rents declined by about 1%. Although rents are still slightly below pre-pandemic levels (2019), the momentum indicates a full recovery is near.

The Tech Layoff Effect

Despite growing optimism in AI, tech layoffs continue to weigh on the broader economy.

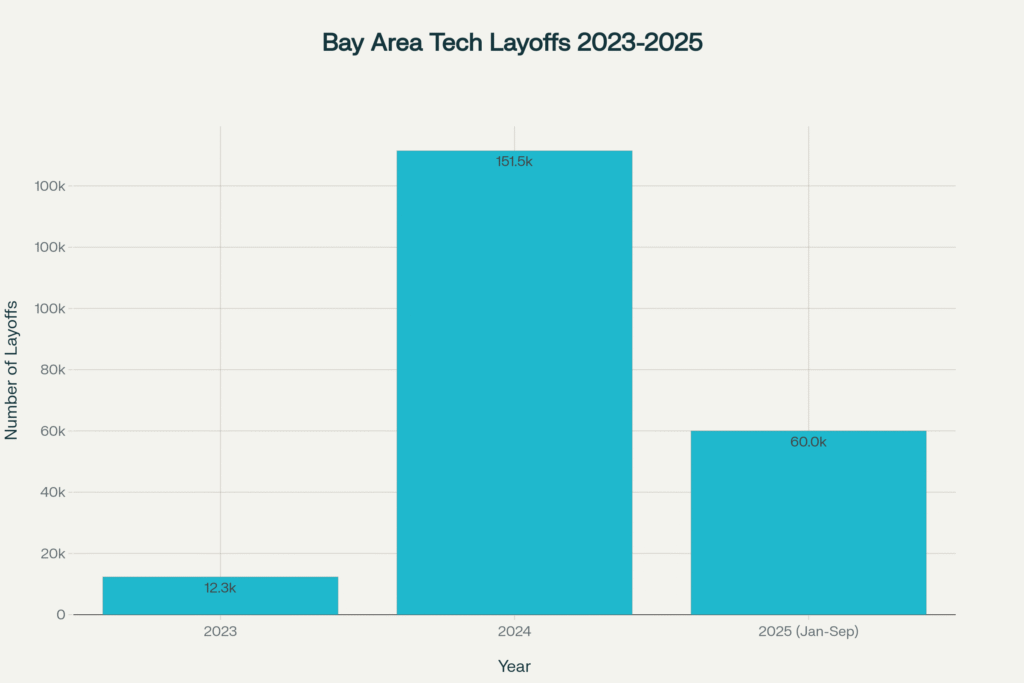

- 8,700 jobs were cut across Bay Area tech firms in just the first two months of 2025.[9]

- The South Bay and San Francisco–San Mateo regions bore the brunt, losing 4,100 and 3,700 positions, respectively.

- The region’s unemployment rate rose to 4.3%, up from 4.2% in mid-2025.[12]

In total, nearly 60,000 U.S. tech employees have been laid off so far in 2025 — following 151,000+ in 2024.[11]

Yet, the economic ripple effects are less pronounced than expected, thanks to one powerful counterforce: AI.

AI Boom: The Counterbalance

The AI sector has become the Bay Area’s saving grace.

- Over $29 billion in AI venture funding poured into the San Francisco Metro area in the first half of 2025 — more than double 2022 levels.[13]

- AI-related companies accounted for nearly half of all U.S. AI investments this year.

- Office leasing by AI firms surged 107% year-over-year, led by giants like OpenAI and Anthropic.[14][15]

These companies aren’t just expanding offices — they’re hiring aggressively.

40% of new San Francisco renters in 2025 reportedly relocated for AI sector jobs.[3]

That demand has single-handedly revived urban housing and rental activity, even as other submarkets cool.

Regional Breakdown

🏙 San Francisco City: The Clear Winner

- Home sales +5% YoY

- Median home price +5%

- Rents +12%, highest in the U.S.

- Inventory remains tight with 1.8 months supply

💻 Silicon Valley: Cooling Off

- Home sales down 13%

- Condo sales down 22%

- Inventories up over 30%

- More balanced conditions emerging, favoring buyers

🌉 East Bay: Mixed Market

- Home sales up 50% in Q2 2025

- Median prices down 6.8%

- Inventory surging, suggesting more buyer leverage[18]

2026 Forecast: What’s Ahead

According to the California Association of Realtors (C.A.R.), 2026 will bring modest growth:

- 274,400 sales statewide (+2%)

- Median price: $905,000 (+3.6%)

- Affordability: Slight improvement to 18%[19]

However, Zillow predicts a 6.1% price drop for the San Francisco Metro area by mid-2026 — a sharper correction than in Los Angeles or San Diego.[20]

On the rental side, vacancy rates are at their lowest since 2019, with AI hiring expected to sustain demand through 2026.[21]

Key Risks Ahead

The 2026 outlook remains cautiously optimistic, but several risks could shift the balance:

- Interest rate volatility could impact affordability.

- Stock market trends still heavily influence luxury housing.

- AI regulation and saturation may cool hiring momentum.

- Zoning and construction costs continue to restrict housing supply in core areas.

Final Takeaway

The San Francisco Bay Area is no longer one unified market — it’s a collection of micro-markets, each responding differently to the tech and AI revolutions.

While traditional tech layoffs have slowed regional growth, AI’s rise has reignited demand in San Francisco itself, driving a 5% sales increase and 12% rent surge in 2025 alone.

Looking ahead, 2026 will likely extend this bifurcated pattern:

- San Francisco will remain premium-priced, fueled by AI expansion.

- Suburban tech hubs may stabilize or cool further.

For buyers, investors, and renters alike, local context matters more than ever — because in today’s Bay Area, the difference between a cooling market and a booming one could be just a few miles apart.

- Here’s a polished and professional rewrite of your disclaimer and source section:

Disclaimer

The information presented in this article is derived from research and publicly available data obtained from reputable real estate, economic, and news outlets as of 2025. While Onetipass.com has made every effort to ensure the accuracy and reliability of the information provided, real estate market trends, economic conditions, and statistical data are subject to change over time.

Readers are strongly encouraged to perform their own research and, when necessary, consult with a licensed real estate professional or financial advisor before making any investment or housing-related decisions. Onetipass.com does not assume responsibility for any actions taken based on the information contained in this article.

Sources

These findings are based on publicly accessible housing market data, technology employment reports, and AI investment analyses as of 2025. Key insights and statistics were obtained from the following reputable sources:

San Francisco Chronicle – Housing Market Overview (2025)

Business Insider – AI and Real Estate Boom in San Francisco (2025)

San Francisco Chronicle – Rent Surge Report (2025)

Axios – AI Hiring and Housing Shortage in San Francisco (2025)

Wolf Street – Tech Job Decline and Housing Price Reaction (2025)

Cal Corporate Housing – Bay Area Corporate Housing Boom (2025)

Norada Real Estate – Bay Area Market Forecast (2025–2027)

The Cal Agents – Tech Layoffs and Home Price Impact (2023)