From Silicon Hills to Reality Check: Austin’s 17% Rent Drop and What It Means for 2026

🏡 Austin Housing & Rental Market 2025: Tech Shifts, Falling Rents, and the Path to Balance

Market Overview: A Tale of Two Corrections

Austin’s housing and rental markets have undergone significant corrections in 2025, with both sectors experiencing notable shifts from their pandemic-era peaks. The Austin-Round Rock-San Marcos metropolitan area is witnessing a transition from a seller’s market to increasingly buyer-friendly conditions, driven by rising inventory, cooling demand, and tech sector adjustments.

Housing Market Trends

Price Corrections and Inventory Surge

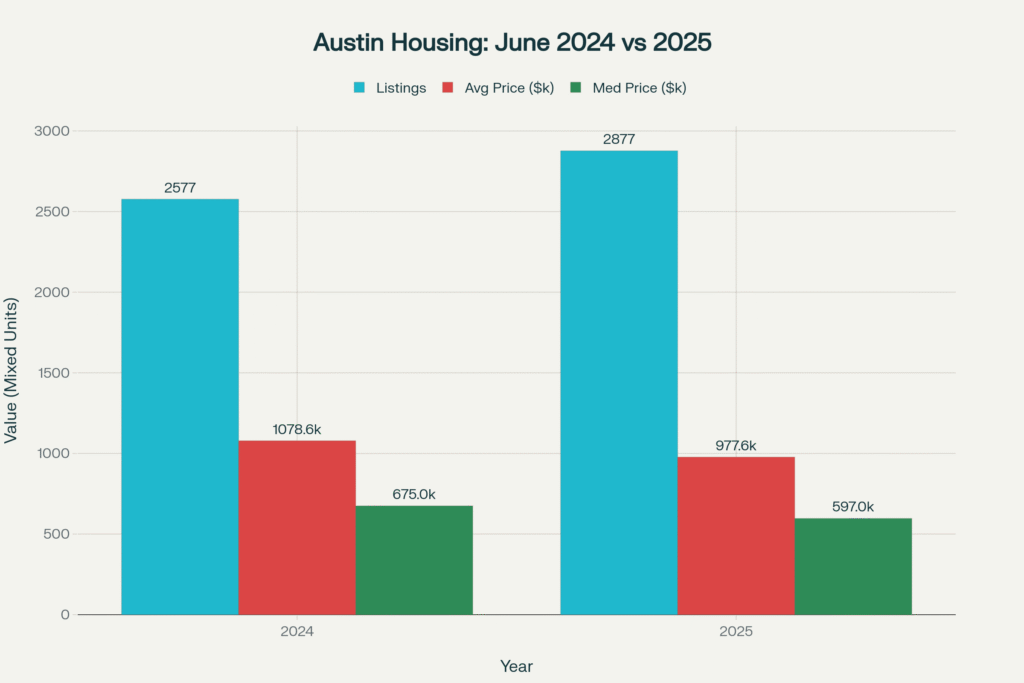

The Austin housing market is experiencing its largest inventory surge in over a decade. Active listings reached 15,796 in May 2025, representing a 21% increase year-over-year. This inventory buildup has pushed months of supply to 5.65 months, well above the neutral threshold of 4.0, signaling a shift toward buyer market conditions.

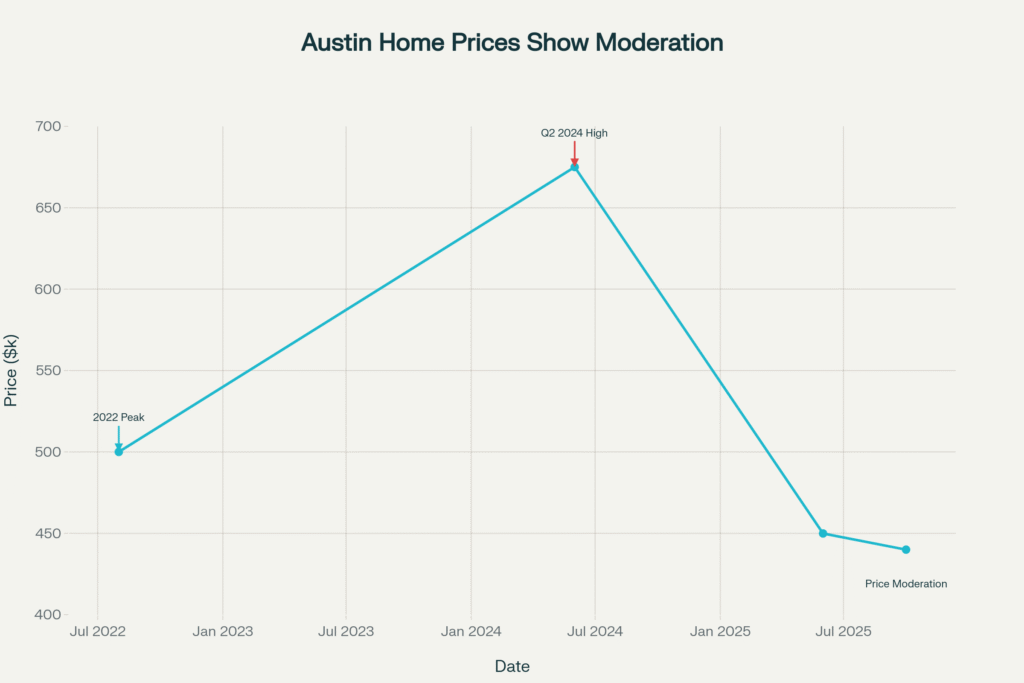

Median home prices have shown mixed but generally declining trends. In June 2025, the median sales price was $449,900, remaining flat compared to the previous year. However, median list prices have fallen 13.2% since August 2022, with some recent data showing median sales prices down 2.2% in the first half of 2025 to $439,970.

Inventory Analysis by Price Segments

The inventory surge is particularly pronounced in entry-level housing. Entry-level homes (below $300,000) have seen inventory accelerations of 39% year-over-year since April 2024, while homes in the $300,000-$500,000 range increased 30%. This surge in affordable inventory represents a significant shift, as Austin posted the highest inventory level affordable to the standard household since 2012.

Market Trajectory Forecast

Industry analysts predict continued buyer leverage through at least 2026. The gap between active listings and pending listings reached a 20-year high in June 2025 at 12,605, a level not seen since the post-financial crisis period of 2010. This suggests buyers will maintain leverage for the next 12 to 18 months.

Rental Market: Dramatic Vacancy Increases

Apartment Vacancy Surge

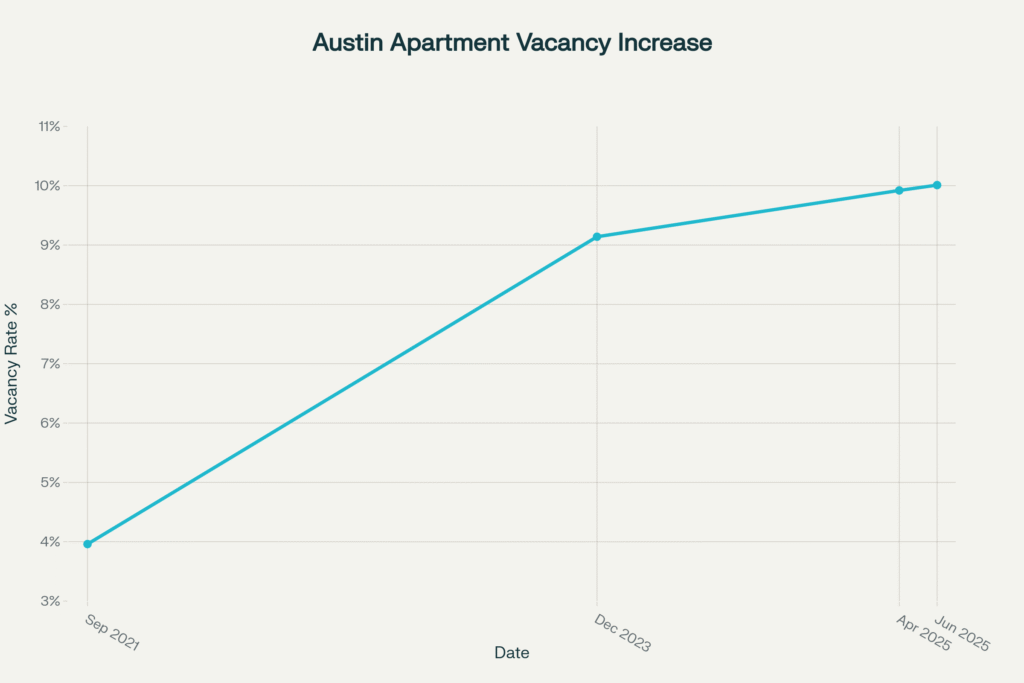

Austin’s rental market has experienced one of the nation’s most dramatic corrections. Apartment vacancy rates reached 10.01% in June 2025, placing Austin among the top 5 metro areas nationally for apartment oversupply. This represents a massive increase from the low of 3.96% in September 2021.

Rent Declines

Two-bedroom apartment rents have fallen 17.44% from their peak, dropping from $1,726 in August 2022 to $1,425 in June 2025. The decline has been particularly steep since late 2022, with rents falling from $1,567 in November 2023 to $1,431 by April 2025.

Supply Surge Impact

The vacancy surge stems largely from new construction completions. Austin had 78.1 permits per 100,000 population for 5+ unit buildings in 2024, up from 41 in 2017. Many units permitted during the 2022-2023 construction boom are now coming online, adding significant supply that outpaces current demand.

Tech Sector Impact on Housing Markets

Employment Trends and Corrections

Austin’s tech sector has experienced notable corrections in 2025, though less severe than many other tech hubs. While tech employment declined by less than 1% in 2024, the city has faced challenges from major layoffs and company restructuring.

Intel laid off 110 workers in Austin in July 2025, following previous cuts of 250 jobs. However, the broader impact has been more about slowed hiring rather than massive job losses. Austin ranked 30th nationally for job creation in August 2025, down from being in the top 10 earlier in the year.

Tech Company Expansions vs. Contractions

Despite some layoffs, major tech expansions continue. Apple is investing $1 billion in a development bringing 15,000 jobs, while Amazon’s Tech Hub is adding 3,000 positions. Google is establishing a new tech center, and SpaceX is building a Starlink manufacturing facility.

The startup ecosystem remains robust with over 4,500 companies and $4 billion in VC investment in 2024. Austin maintained its position as having the most Inc. 5000 companies per capita.

Migration Pattern Shifts

Tech worker migration to Austin has slowed significantly. From May 2024 to April 2025, migration of tech, information and media workers from San Francisco to Austin decreased 23%. This represents a reversal from pandemic-era migration trends that initially drove housing demand.

Office Market Pressures

Austin’s office market reflects broader tech sector adjustments. Office vacancy rates reached 26% in Q2 2025, placing Austin among the most vacant major office markets nationally, trailing only San Francisco and Houston. Downtown Austin specifically shows 31.8% vacancy in its 16.8 million square feet of office space.

Nearly 2.7 million square feet of additional office space remains under construction, suggesting continued pressure on vacancy rates through 2026.

Construction and Development Trends

Multifamily Construction Slowdown

Multifamily construction permits have declined dramatically. Austin developers obtained permits for 64.5 multifamily units per 10,000 people from April 2024 to March 2025, down from nearly 95 units per 10,000 during the pandemic surge. However, Austin still leads the nation in multifamily permitting per capita.

Single-Family Construction

New home starts have normalized to approximately 15,500 annually in 2025, down from over 26,000 in 2021. This level aligns with Austin’s long-term average of 14,000-15,000 annually, suggesting the market has stabilized after pandemic-era excess.

Comparison to 2024

Housing Market Year-Over-Year Changes

Comparing 2024 to 2025 data shows clear trends toward increased inventory and price moderation. Active listings in Austin grew 12% from 2,577 in 2024 to 2,877 in 2025. Average home prices declined from $1,078,628 to $977,610, while median prices dropped from $674,999 to $597,000.

Rental Market Evolution

The rental market correction accelerated through 2025. Vacancy rates climbed from 9.14% in December 2023 to 9.92% by April 2025, representing continued deterioration in landlord pricing power.

Market Outlook and Implications

Austin’s housing and rental markets are experiencing a significant recalibration after years of pandemic-driven growth. Rising inventory, moderating prices, and increased vacancy rates suggest continued buyer and renter leverage through 2026. While tech sector corrections have contributed to demand softening, Austin’s diversified economy and continued corporate expansions provide underlying support.

The combination of elevated construction deliveries, slowed tech hiring, and normalized migration patterns has created a more balanced market environment. For buyers and renters, this represents the best conditions in years, with increased choice, negotiating power, and improved affordability compared to the peak pandemic period.

However, the oversupply situation, particularly in apartments and office space, suggests the correction may continue into 2026 before markets fully stabilize.

Disclaimer

This article is based on compiled market data and research from reputable public sources as of 2025.

It is intended for informational and educational purposes only and does not constitute financial, investment, or legal advice.

Readers should always conduct their own research or consult local professionals before making property decisions.

Sources

[1] Team Price Real Estate – Austin Housing Market Forecast 2025–2026

[2] Unlock MLS – June 2025 Central Texas Housing Report

[3] Realtor.com – Austin Buyers Market Report August 2025

[4] Unlock MLS – April 2025 Central Texas Housing Report

[5] Texas Real Estate Research Center – Texas Housing Insight March 2025

[6] Team Price Real Estate – Buyer’s Leverage Forecast 2025–2026

[7] Team Price Real Estate – Why Is Rent Going Down in Austin (2025 Data)

[8] Team Price Real Estate – Austin Apartment Vacancy Rate & Rent Trends 2025

[9] Opportunity Austin – Tech Resilience: Built for What’s Next

[10] RealPage – August 2025 Metro Employment Update

[11] GovTech Insider – Major Tech Companies Cutting Jobs in Texas

[12] Nucamp – Getting a Tech Job in Austin in 2025

[13] Dealroom – Austin Startup Ecosystem Guide

[14] Wall Street Journal – Austin’s Reign as a Tech Hub Might Be Ending

[15] Austin Monitor – Office Slowdown Sparks New Downtown Housing Ambitions

[16] RRS Firm – Office Vacancy Remains High in Austin

[17] Arbor Realty – Top Markets for Multifamily Permitting per Capita

[18] Axios – Apartment Building Permits Plummet in Austin

[19] Spyglass Realty – Austin Economic Forecast 2025

[20] Team Price Real Estate – Austin Market Trends 2024 vs 2025

[21] Team Price Real Estate – Austin Apartment Rents 2025 Update

[22] Norada Real Estate – Austin Real Estate Market 2025

[23] LRG Realty – Is Austin’s Housing Market Cooling in 2025?

[24] Realtor.com – August 2025 Rental Report

[25] The Economist – America’s Housing Market Is Shuddering (Aug 2025)

[26] CultureMap Austin – May 2025 Real Estate Report

[27] StartUs Insights – Austin Startups Guide

[28] Forbes – U.S. Housing Market Predictions 2025

[29] LiveTheAnderson – Austin Apartment Market Trends 2025

[30] Fundraise Insider – Recently Funded Startups in Austin

[31] Minut – Best Long-Term Rental Markets 2025

[32] iProperty Management – Rental Vacancy Rate Research

[33] Seedtable – Best Startups in Austin

[34] CNBC – What to Watch in the 2025 Housing Market

[35] Partners Real Estate – Austin Office Quarterly Report Q2 2025

[36] Y Combinator – Austin Companies

[37] Nucamp – Top Tech Companies to Work for in Austin 2025

[38] Papermark – Austin Startup Accelerators

[39] Built In Austin – Tech Jobs in Austin

[40] Opportunity Austin – Job Growth & Unemployment Update June 2025

[41] Indeed – Tech Jobs in Austin

[42] Austin Werner – Tech Job Market Analysis

[43] BuiltIn – U.S. Tech Job Listings

[44] Revli – Funded Startups in Austin

[45] Reddit – Best U.S. Tech Hubs 2025

[46] Apartments.com – National Rent Trends Report

[47] Move to Austin – Companies Expanding to Austin, TX

[48] Visual Capitalist – America’s Fastest Rising and Falling Housing Markets

[49] Independence Title – Where Are We Headed and What Is Normal?

[50] Apartment List – National Rent Data

[51] Y Combinator – Austin Companies Hiring

[52] Zillow – Austin, TX Home Values

[53] FinalRound AI – AI & Tech Layoffs Mid-2025

[54] TechCrunch – Tech Layoffs 2025 List

[55] Course Report – The “Techxodus” Migration Study

[56] Team Price Real Estate – Austin Building Permits Surge 2024 Data

[57] FastExpert – Remote Work and the Migration Boom

[58] Newmark – Austin Office Market Report Q2 2025 (PDF)

[59] CorecastRE – Migration Patterns and CRE Growth Study

[60] Commercial Café – National Office Report

[61] Karat – Tech Talent Migration 2025

[62] Redfin – Multifamily Construction Permits 2025