The Looming Storm: How Corporate Layoffs Could Reshape America’s Housing Market in 2026

As we head into 2026, a perfect storm is brewing in America’s housing market. The wave of corporate layoffs that began sweeping across the nation in late 2025 isn’t just a jobs story—it’s quickly becoming a housing story. And if you’re a homeowner, prospective buyer, or renter in a tech-heavy city, you need to pay attention.

The Numbers Are Staggering

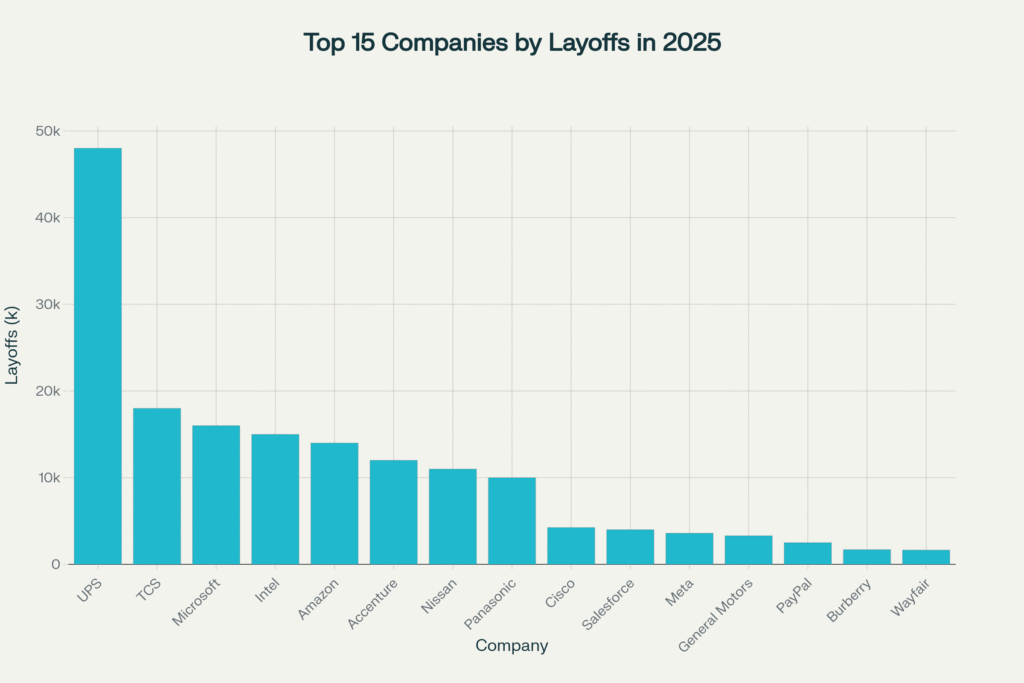

Let’s start with the sobering reality: 168,338 confirmed job cuts in 2025, with an additional 24,500 already announced for 2026. These aren’t just numbers on a spreadsheet—they represent families, mortgages, and communities facing uncertainty.

The scale of these layoffs is unprecedented. UPS leads the pack with a crushing 48,000 position eliminations (34,000 operational and 14,000 corporate roles). TCS follows with 18,000 cuts, Microsoft with 16,000, and Intel with 15,000. Amazon announced 14,000 corporate layoffs, though internal documents suggest the company is planning up to 30,000 total reductions and aims to automate approximately 600,000 roles by 2033.

Other major employers slashing their workforces include Accenture (12,000), Nissan (11,000), Panasonic (10,000), and Cisco (4,250). The breadth of industries affected is striking—from logistics to semiconductors, from automotive to e-commerce.

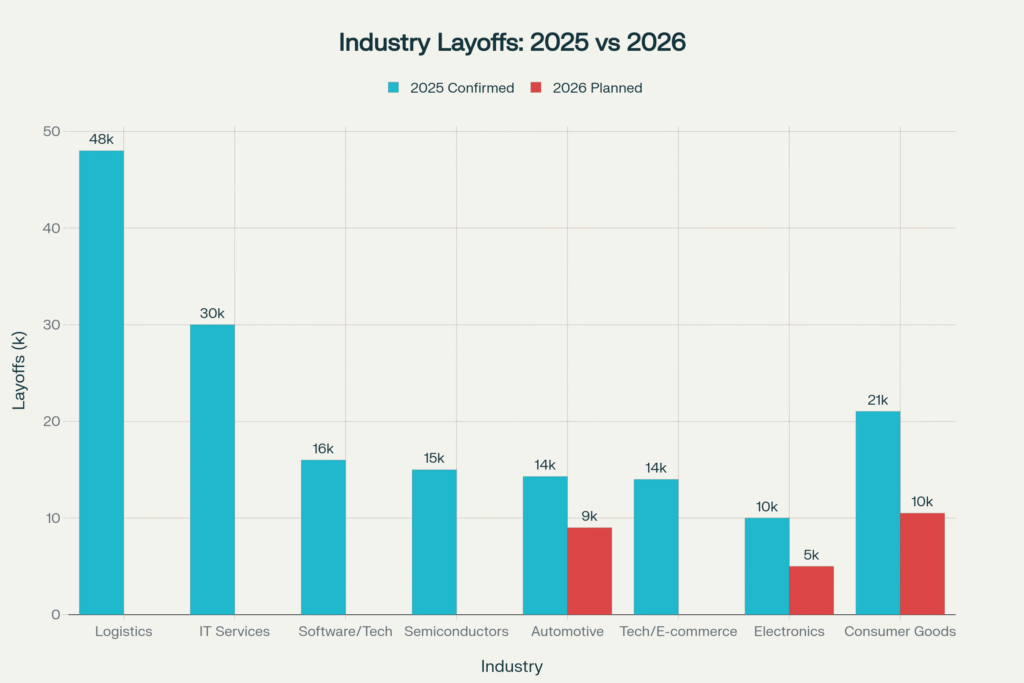

Breaking Down the Industry Impact

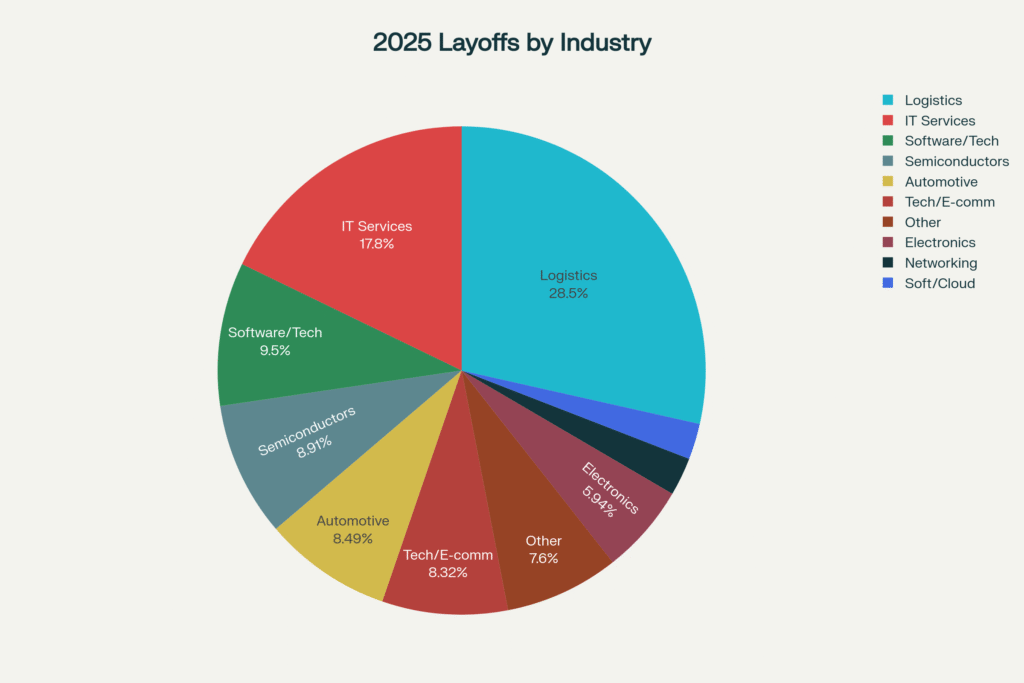

When we look at where these job losses are concentrated, the picture becomes even clearer:

- Logistics: 48,000 jobs (28.5%) – primarily UPS

- IT Services: 30,000 jobs (17.8%) – Accenture and TCS

- Software/Tech: 16,000 jobs (9.5%) – Microsoft

- Semiconductors: 15,000 jobs (8.9%) – Intel

- Automotive: 14,300 jobs (8.5%) – Nissan and GM

- Tech/E-commerce: 14,000 jobs (8.3%) – Amazon

- Electronics: 10,000 jobs (5.9%) – Panasonic

- Other sectors: 21,038 jobs (12.5%)

What’s particularly concerning is the concentration in high-wage tech sectors—the very industries that have been driving housing demand in cities like San Francisco, Seattle, and Austin for the past decade.

Will This Actually Impact Housing? Experts Say Yes

Here’s where it gets real. Industry experts and economists are in rare unanimous agreement: these layoffs will significantly impact housing markets, especially in the near term.

The statistics are eye-opening. There’s a 94% statistical correlation between employment levels and housing prices. Let that sink in—94%. This means that approximately 94% of housing price variation can be explained by employment changes alone.

Ali Wolf, Chief Economist at Zonda Housing Research, put it bluntly: “The housing market is fueled by confidence, affordability, and most importantly, jobs. Housing demand in tech-heavy metros is expected to be lower in the near-term.”

But it’s not just about the people who lose their jobs. Wolf emphasized that the psychological damage is significant—when you see your neighbors and colleagues getting laid off, it dampens buyer confidence even if you’re still employed. Suddenly, that dream home purchase feels a lot riskier.

How the Dominoes Fall

The mechanism of impact is straightforward but devastating:

Decreased Housing Demand: When layoffs hit, uncertainty about employment stability creates immediate ripple effects. Mortgage lenders require documented employment history, so as unemployment rises, fewer people qualify for mortgages. Meanwhile, homeowners facing job loss become forced sellers, flooding the market with inventory at discounted prices and establishing new comparable sales benchmarks that suppress overall valuations.

Foreclosure and Distressed Sales: When jobless homeowners can’t maintain mortgage payments, foreclosure rates rise and distressed sales increase. Economists note this situation differs from 2008 because most mortgage holders still have employment or dual-income households, providing some cushion—but the risk remains real.

Rental Market Effects: Many displaced workers or discouraged buyers shift to rental markets, potentially increasing rental demand and driving rents higher in markets without sufficient new rental construction. However, this effect varies dramatically by location.

The Timeline: When Will We Feel the Pain?

Experts have mapped out a clear timeline for how these impacts will unfold:

Q4 2025 (Right Now): The psychological impact has already begun. Massive layoff announcements are dampening consumer confidence, with initial effects visible in home sale cancellations and reduced mortgage applications.

Q1-Q2 2026 (The Critical Period): This is when the full employment effects will show up in housing data. Experts expect housing prices to decline 1-5% depending on regional tech concentration. The San Francisco Bay Area is already forecasting a 5.2% decline from April 2025 to April 2026.

H2 2026 (Stabilization?): Markets may begin to stabilize as the economy adjusts to new employment baselines. If the Federal Reserve begins cutting rates (though this seems unlikely until late 2026), market psychology might shift toward recovery.

Ground Zero: Which Cities Are Most at Risk?

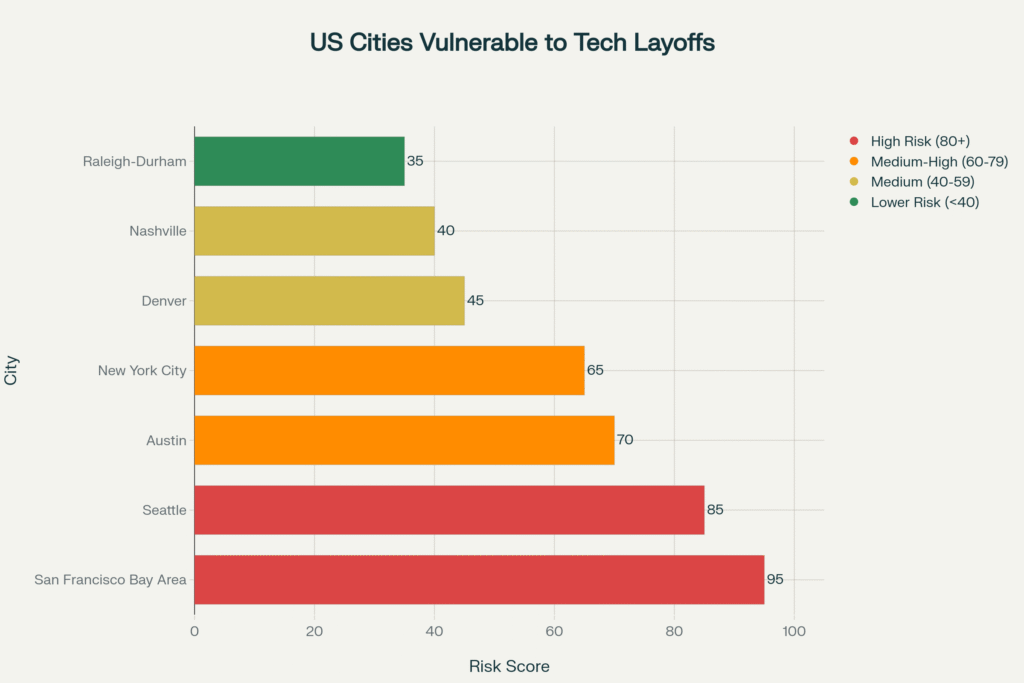

Not all housing markets are created equal. Here’s how different cities stack up in terms of vulnerability:

Tier 1: Extreme Risk (90%+ Vulnerability)

San Francisco Bay Area is the most vulnerable market in the nation. The region already faces massive affordability challenges with wage-to-cost ratios exceeding 80-120% in counties like Marin and Santa Cruz. With concentrated tech job presence from Amazon, Google, Meta, Microsoft, Apple, and Salesforce, the Bay Area is staring down a perfect storm:

- Forecasted 5.2% home price decline from April 2025 to April 2026

- San Francisco and San Jose experiencing elevated home sale cancellations (6-8% failure rates)

- Already stressed rental market with 1.03% vacancy rates (historically low levels)

- Market valuations already declined 1.9% by July 2025 with further drops expected

Tier 2: High Risk (80-89% Vulnerability)

Seattle, Washington faces severe exposure due to its historic Amazon and Microsoft presence. The city is already experiencing rent declines, and further job losses will intensify downward pressure on both purchase prices and rental rates.

Tier 3: Moderate-High Risk (60-79% Vulnerability)

Austin, Texas has seen explosive tech growth but maintains a more diversified economy than the Bay Area or Seattle. The city has been adding nearly 19,000 jobs annually despite layoffs, with major employers including Apple, Google, and Oracle. Austin demonstrates moderate resilience due to diverse technology and government employment sectors, though certain zip codes will still see severe impacts.

New York City faces medium-high risk due to emerging tech concentration in Manhattan and Brooklyn, plus the finance sector’s sensitivity to economic downturns.

Tier 4: Moderate Risk (40-59% Vulnerability)

Denver, Colorado maintains stronger economic resilience through aerospace, energy, and diverse tech sectors, with employment rising 3%+ annually despite layoffs.

Nashville, Tennessee benefits from Oracle’s planned headquarters relocation and diversified healthcare and music industry job bases.

Tier 5: Lower Risk (<40% Vulnerability)

Raleigh-Durham holds the strongest position due to top-tier universities, biotech companies, and federal research facilities, keeping unemployment impressively low at 3.2% despite national trends.

What This Means for Prices

Capital Economics expects housing prices may fall 1.4% nationally by mid-2026, with tech hubs experiencing 3-5% declines. However, high mortgage rates (expected to remain around 6.8-7% through much of 2026) will limit how far prices can fall, as the severe housing shortage (1.5-2 million units according to Moody’s Analytics) constrains supply.

Here’s the frustrating part: the housing affordability crisis that defines 2025 is unlikely to improve through 2026. High prices and elevated mortgage rates are expected to persist, preventing meaningful improvement for homebuyers despite employment weakness providing some price relief.

The Employment-Housing Connection by the Numbers

Research shows that 1,000 jobs of employment change produces dramatic housing market effects within 1-2 years:

- Rental price changes: 0.5-1% per 1,000 jobs

- Sale price changes: at least 2% per 1,000 jobs

- Information/tech sector employment: ~10% effect per 1,000 jobs (much larger multiplier than other sectors)

- Manufacturing employment: ~1% effect per 1,000 jobs (minimal housing impact)

This means the 168,000+ job losses expected in 2025-2026 represent approximately 1.7 employment events, suggesting housing prices could decline 3.4-34% depending on sector composition. Given that job losses are concentrated in high-multiplier sectors like IT Services, Tech, and Semiconductors, the actual impact will likely be in the higher range of this estimate for affected regions.

The Rental Market Wild Card

The rental market presents a more complex picture. While rents may face pressure in markets experiencing heavy tech job losses, overall rental demand could actually increase as discouraged buyers shift to renting. The outcome depends heavily on whether new rental construction keeps pace with demand.

Most experts expect:

- Flat to modest rental price growth in 2026

- Increased renter quality as high-earning tech workers look to preserve capital

- Potential for selective rent declines in over-developed tech markets with excess supply

- Persistent rent inflation in supply-constrained markets with lower tech job exposure

What Could Make Things Better (or Worse)

Factors That Could Limit Housing Decline:

- Fiscal Stimulus: The Trump administration’s announced infrastructure and tax policies could stimulate job creation offsetting some layoffs

- Federal Reserve Policy: Unexpected rate cuts could inject demand even with weak employment

- Tech Sector Resilience: High-wage displaced workers may maintain housing purchases through savings or dual incomes

- Supply Shortage: The persistent housing shortage (1.5-2 million units) may prevent severe price declines despite demand weakness

Factors That Could Amplify Housing Decline:

- Concentrated Impact: Layoffs concentrated in high-multiplier tech sectors amplify housing market effects

- Mortgage Rate Persistence: High rates (6-7%) combined with weak employment creates a worst-case demand scenario

- Foreclosure Risk: Even if limited by dual-income households, any spike in defaults could trigger cascading price declines

- Psychological Effects: Perception of a broader recession could prompt preemptive selling before markets stabilize

The Bottom Line

The 168,338 confirmed job losses in 2025 and 24,500 planned for 2026 across major corporations will measurably and negatively impact housing markets nationwide, with effects most severe in the San Francisco Bay Area, Seattle, and Austin. Peak impacts are expected to materialize in Q1-Q2 2026, with housing prices declining 1-5% nationally and 3-7% in technology-dependent regions.

The extremely high statistical correlation (94%) between employment and housing prices, combined with concentrated layoffs in high-multiplier tech sectors, suggests the housing market will face significant headwinds through mid-2026. Potential stabilization may only emerge if unemployment growth moderates and Federal Reserve policy shifts favorably.

For homeowners in tech-heavy markets, this is a wake-up call. For prospective buyers, it may represent an opportunity—but timing will be everything. And for renters, the picture is mixed: you might see some relief in certain markets, but don’t count on it everywhere.

One thing is certain: the next 6-12 months will be critical for America’s housing market. The question isn’t whether these layoffs will have an impact—it’s how severe that impact will be.

📚 Sources & Further Reading

- CBS News — Amazon, UPS layoffs and the U.S. labor market impact

- NBC News — Are AI-related layoffs really about automation?

- Realtor.com — Fed rate cuts and Amazon layoffs shake housing markets

- GoLocalProv — Layoff mania: Amazon, UPS, GM, Target job cuts

- Economic Times — U.S. job bloodbath: 172,000 jobs vanish

- LinkedIn News — Layoffs mount as Amazon, UPS announce job cuts

- Yahoo News — AI-related job cuts rise across major tech companies

- Business Insider — Recent company layoffs and restructuring

- Economic Times — Inside Amazon’s 30,000 job cuts and automation drive

- Economic Times — Meta’s layoff memo to employees

- Reim Capital — Housing prices and unemployment rate correlation

- The Hill — How big tech layoffs could hit expensive housing markets

- Yahoo Finance — The real estate impact of major tech layoffs

- America’s Credit Unions — Potential federal layoffs and housing impacts

- Loftway — How unemployment influences real estate markets

- LinkedIn — SF Bay Area housing market truth: Summer 2025 analysis

- TD Economics — Gradual U.S. housing recovery outlook

- Batlin Group — 2025’s riskiest U.S. housing markets

- Reddit — Community insights on layoffs and home prices

- Suburban Solutions — Layoffs and housing market shifts

- Fast Company — NYC and Austin tech relocation report

- Business Insider — Mortgage rates, affordability, and 2026 housing outlook

- London School of Economics — Impact of employment on housing markets (Lyons, 2018)

- Rezi.ai — When will tech layoffs stop?

- Independent — U.S. layoffs: Amazon, Target, UPS job cuts overview

- CNN — What Amazon’s mass layoffs are really about

- TechCrunch — 2025 tech layoffs list

- Intellizence — Major companies announcing mass layoffs

- Futunn News — Weak employment and real estate concerns

- Prospect by Buildout — How layoffs impact the real estate market

- MishTalk — Huge layoffs: Amazon, GM, UPS, and more

- Site Selection Group — Ripple effects of 2024 tech layoffs

- Moomoo News — Weak employment and real estate slowdown

- Hong Kong Business — JLL warns extended slump in property markets

- CNBC — Microsoft announces 9,000 layoffs in latest cuts

- Forbes — Amazon may lay off 30,000 employees amid automation drive

- Top Gear — Nissan cutting 20,000 jobs and halting new models

- Los Angeles Times — Layoffs pile up, raising worker anxiety

- KPMG — Residential property market outlook (June 2024)

Again, please remember: This article is for informational purposes only. Always conduct your own thorough research and consult with qualified financial and real estate professionals before making any decisions related to employment, housing purchases, or investments.

Disclaimer: The information presented in this article is based on research from publicly available online sources. Readers are strongly encouraged to conduct their own independent research and verify all facts and figures before making any financial or real estate decisions. We assume no responsibility for the accuracy, completeness, or applicability of this information to individual circumstances.