Rent Increases in Toronto, Vancouver, and Alberta: What You Need to Know in 2025

Rising costs, tighter markets, and inflationary pressures have once again brought rent increases into focus. Whether you’re a landlord trying to keep up with expenses or a tenant budgeting for stability, knowing the rules that govern rent hikes in your province can make all the difference.

Let’s break down how rent increases work in Ontario, British Columbia, and Alberta — and why each province takes a slightly different approach.

Ontario (Toronto & Beyond): Slow and Steady

In Ontario, the system is designed for predictability. Under the Residential Tenancies Act, landlords can only raise rent once every 12 months, and only by a set amount known as the “rent increase guideline.”

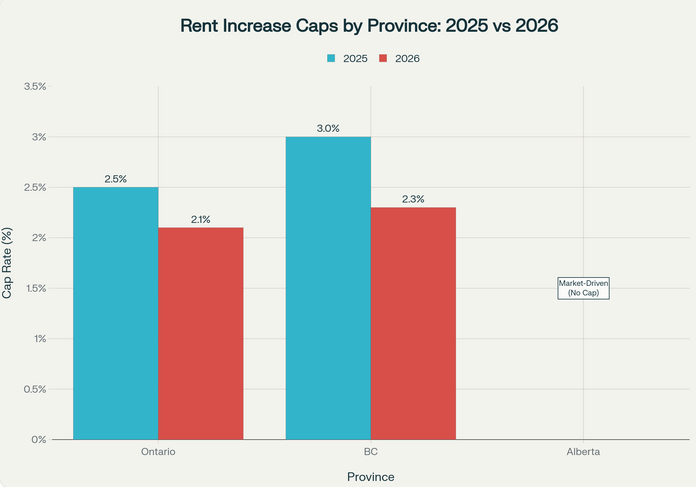

For 2025, that cap is 2.5%, and for 2026, it drops slightly to 2.1%.

Before any rent bump takes effect, landlords must give tenants at least 90 days’ written notice using the official Form N1.

The November 15, 2018 Twist

However, there’s a significant exception — newer units (those first occupied after November 15, 2018) aren’t bound by the guideline, meaning the increase limit doesn’t apply. This exemption covers:

- New buildings and mobile home parks

- Additions to existing buildings

- New self-contained basement apartments (with separate entrances, kitchens, and washrooms)

For these exempt units, landlords still need to provide 90 days’ notice using Form N2, but there’s no cap on how much they can increase the rent.

What’s Actually Happening in the Market?

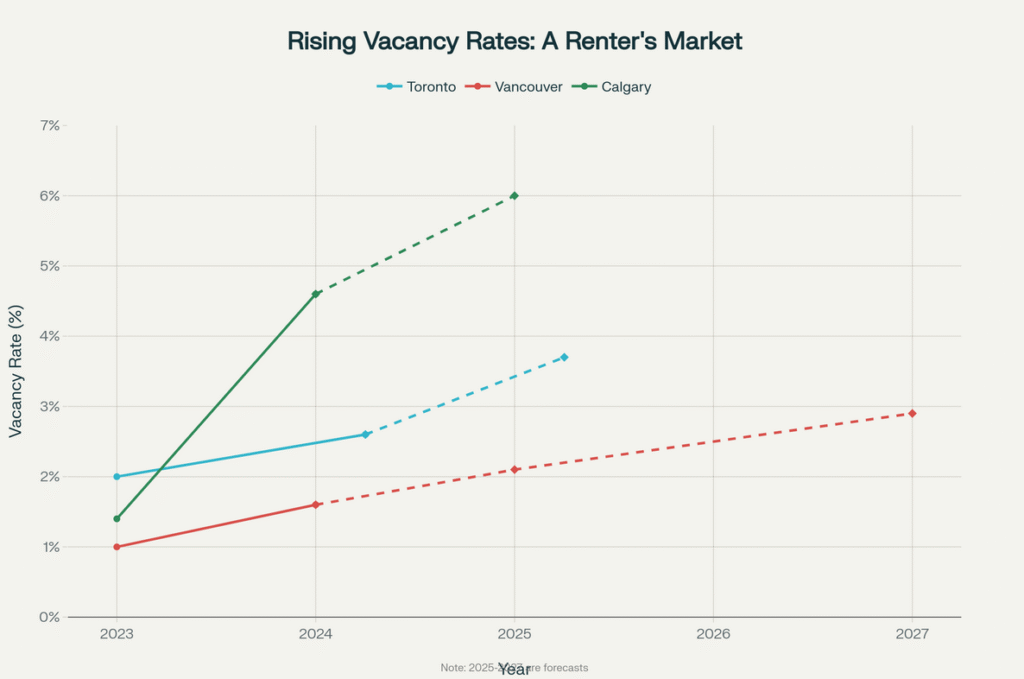

Here’s some good news for Toronto renters: the market has cooled considerably in 2025. Toronto’s rental vacancy rate reached 3.7% in Q1 2025 — up from just 2.6% the year before. Purpose-built rental rents declined 2.2% year-over-year, and when you factor in landlord incentives (now offered by 63% of buildings), effective rents dropped a whopping 7% annually.

For tenants: This offers stability and protection from sudden jumps, plus a more competitive market working in your favor.

For landlords: It ensures consistency but can make it harder to keep up with rising property taxes, utilities, and mortgage costs — especially when your allowed increase is only 2.1% but your property taxes went up 5%.

British Columbia (Vancouver & Surrounding Areas): Moderate but Structured

Over on the West Coast, British Columbia’s rent increase rules are similar — but a bit more flexible.

For 2025, the maximum allowable increase is 3.0%, dropping to 2.3% in 2026. Like Ontario, landlords can raise rent only once every 12 months and must provide three full months’ written notice using the province’s official rent increase form (RTB-7).

Going Above the Cap: When It’s Allowed

BC’s Residential Tenancy Branch also allows landlords to apply for additional increases in certain cases, such as when major capital improvements or extraordinary expenses have been made. This includes:

- Major system repairs or replacements (heating, plumbing, electrical)

- Compliance with health, safety, and housing standards

- Energy efficiency improvements

- Security enhancements

These additional increases are capped at 3% annually (on top of the regular increase) and must be amortized over 10 years. Tenants can dispute these applications, and landlords must provide detailed evidence.

Vancouver’s Rental Reality Check

Vancouver’s rental market has experienced a dramatic shift. The vacancy rate reached 1.6% in 2024 (the highest in 20 years outside the pandemic) and is projected to climb to 2.1% in 2025 and potentially 2.9% by 2027. Asking rents for two-bedroom purpose-built apartments dropped 4.9% year-over-year in Q1 2025 — the largest decline among major Canadian cities.

For tenants: Annual caps help keep rent increases predictable in one of the country’s most expensive markets, and the current oversupply is working in your favor.

For landlords: There’s room for flexibility through formal capital expenditure applications — but only with proper documentation and approval.

Alberta: Market-Driven and Independent

In Alberta, the rent system runs on a different philosophy: no cap on rent increases.

That doesn’t mean landlords can raise rent at will — far from it. Provincial law requires that at least 12 months (365 days) pass between increases, and proper written notice must be given:

- Month-to-month leases: 3 full tenancy months’ notice

- Week-to-week leases: 12 tenancy weeks’ notice

- Fixed-term leases: Rent can’t increase until the term ends or renews

Essentially, Alberta leaves pricing to the market but balances that with time-based limits.

The “Economic Eviction” Protection

Here’s something crucial that many Alberta renters don’t know about: the emerging concept of “economic eviction.” Alberta courts and the Residential Tenancy Dispute Resolution Service (RTDRS) have increasingly ruled that landlords cannot raise rent to indirectly force a tenant out.

Red flags that might indicate an economic eviction include:

- Significant increases much higher than market average

- Singling out specific tenants while others receive smaller increases

- Ongoing disputes or previous eviction attempts

- No justifiable reason for the increase

If proven, the RTDRS can void the rent increase notice entirely. This represents meaningful tenant protection in an otherwise uncapped system.

Calgary’s Surprising Market Shift

Calgary has seen perhaps the most dramatic rental market transformation. The vacancy rate surged from 1.4% in 2023 to 4.6% in 2024 and is forecast to hit nearly 6% in 2025, driven by record purpose-built rental completions. Average asking rents fell 3.6% year-over-year in the secondary rental market.

For tenants: There’s risk of larger increases on paper, but current market conditions mean landlords have less pricing power. You always get a full year’s notice buffer.

For landlords: You’re free to match market rates, but with vacancy rates climbing, consistency and communication are key to keeping good tenants long term.

Comparison of maximum allowable rent increase percentages across Ontario, BC, and Alberta for 2025-2026

Vacancy rate trends showing how rental markets in Toronto, Vancouver, and Calgary have shifted dramatically in favor of tenants.

A Balanced Reality: The Two-Sided Coin

No matter the province, rent rules aim to balance two competing truths:

Tenants need stability and fair notice to plan their finances. Sudden rent spikes can force families to relocate, disrupt children’s schooling, and create financial hardship. Research shows Ontario rent increased 3.0% in May 2025 (down from 5.4% in April), demonstrating how regulation can moderate price growth.

Landlords face rising costs and need flexibility to maintain their properties. Property maintenance costs have increased 26% since 2022. Material costs are up 11% year-over-year, labor shortages are pushing service prices higher, and repair costs have effectively doubled in 2025. Many landlords now budget 1-2% of their property value annually just for maintenance.

Both sides are navigating the same challenge — how to stay sustainable in a housing market that’s anything but predictable.

The Big Picture: What’s Driving These Changes?

Several macro factors are reshaping Canada’s rental landscape in 2025:

Record Supply Surge

Purpose-built rental completions in Toronto’s GTHA surged 173% in Q1 2025 compared to the previous year. The federal government played a huge role — 88% of new rental builds in 2024 received federal support. This supply boom is directly contributing to falling rents and increased vacancy rates.

Immigration Policy Shift

Federal immigration caps implemented in 2024 have significantly reduced rental demand. Study permit approvals fell 47% in 2024. Canada’s population growth rate dropped to its lowest level for Q2 2025 since 1946 (excluding the pandemic’s initial year).

The Two-Tier Rental Market

Here’s an interesting quirk: while advertised rents are falling, occupied unit rents continue rising 7-17% year-over-year due to turnover resets. This creates a two-tier market where new renters benefit from competitive pricing while long-term tenants remain locked into older leases to avoid higher reset rates.

National asking rents decreased 1.5% annually in June 2025 — a dramatic shift from 2022-2023 when rents increased 8-12% annually.

Year-over-year rent changes showing significant declines across major Canadian rental markets in Q1 2025

Practical Tips: How to Navigate Rent Increases

If You’re a Tenant:

✅ Keep track of your lease dates and notice periods — landlords must follow strict timelines

✅ Know your rights — understand which rent control rules apply to your unit (especially that November 2018 cutoff in Ontario)

✅ Document everything — keep copies of rent increase notices and all communications

✅ Challenge improper increases — if notice periods or amounts don’t comply with provincial law, you can dispute them

✅ Leverage market conditions — with vacancy rates rising, you may have negotiating power

If You’re a Landlord:

✅ Follow provincial timelines and forms religiously — non-compliance can invalidate your increase

✅ Provide transparent explanations — clear communication about rising costs builds tenant trust

✅ Give early notification — informing tenants well beyond minimum legal requirements shows good faith

✅ Consider market realities — with vacancy rates climbing, retention may be more valuable than maximum increases

✅ Document capital improvements — especially in BC, proper records support applications for additional increases

✅ Show empathy and flexibility — good tenants who pay on time are worth keeping, even if it means moderating increase amounts

What’s Next? The Future of Rent Control

As housing pressures grow across Canada, rent-increase rules will likely keep evolving. Here’s what to watch:

Short-term (2025-2026):

- Continued market cooling as supply increases and immigration slows

- Downward pressure on rents in major markets

- Construction slowdowns may reduce future supply — Toronto’s purpose-built rental starts fell 60% in Q1 2025

Medium-term (2026-2027):

- Possible policy adjustments if landlord operating costs continue outpacing allowed increases

- Ongoing debate over rent control effectiveness versus encouraging new supply

- Greater focus on balancing tenant protection with landlord viability to prevent market exits

Final Thoughts

Whether you’re managing an apartment in downtown Toronto, renting a basement suite in Burnaby, or overseeing a condo in Calgary, the same principle applies:

Clear communication and compliance go a long way.

The regulatory frameworks differ — Ontario’s predictable caps, BC’s moderate structure with flexibility for capital improvements, and Alberta’s market-driven approach with emerging economic eviction protections — but all share common requirements: adequate notice, proper forms, 12-month minimums between increases, and good-faith dealings.

If you’re renting, stay informed about your lease dates and provincial protections. If you’re a landlord, make sure every increase follows provincial timelines and forms. A little diligence today avoids disputes tomorrow.

As we navigate 2025’s evolving rental landscape, one thing is clear: understanding your rights, your responsibilities, and the balance between them isn’t just helpful — it’s essential.