The Bad Loan Shock: What’s Behind the Sudden Banking Turmoil

Just when investors hoped 2025’s financial jitters were behind us, two regional banks dropped bombshells on October 16, shaking markets and raising uncomfortable echoes of 2008.

What Happened — and Why It Matters

Zions Bancorporation and Western Alliance Bancorporation revealed major loan problems connected to suspected borrower fraud.

- Zions Bancorporation wrote off $50 million and set aside $60 million in credit loss reserves at its California Bank & Trust unit due to “apparent misrepresentations and contractual defaults.”

- Western Alliance sued a borrower over false collateral documentation and missing liens.

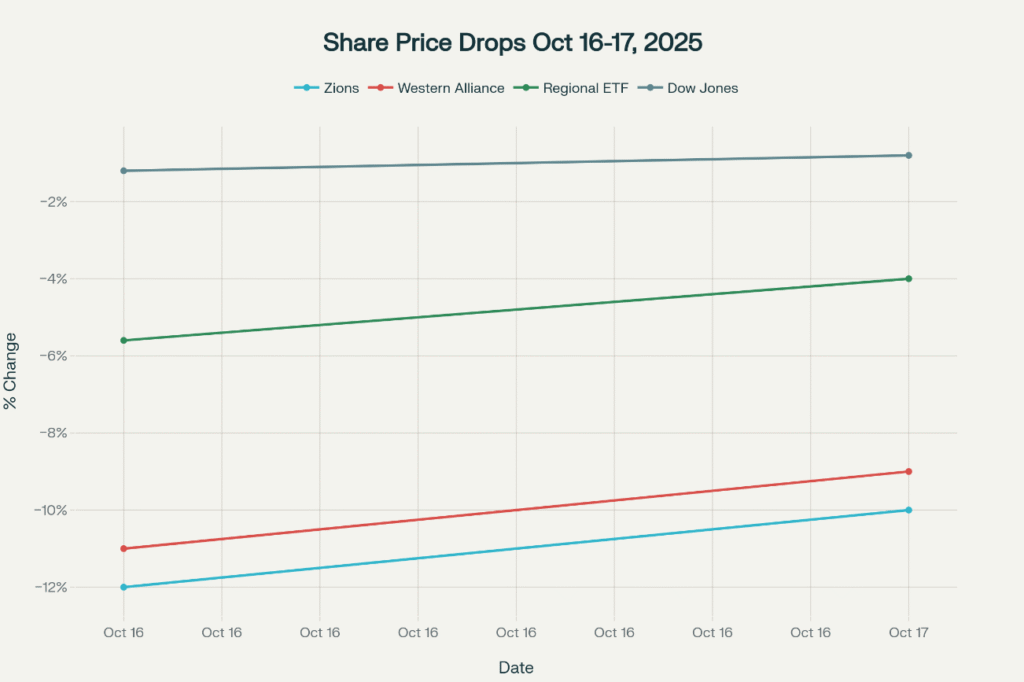

These shocks hit markets hard:

- The SPDR S&P Regional Banking ETF plunged 5.6%, the biggest decline since April.

- Shares of Zions and Western Alliance dropped 12% and 11%, respectively.

- The ripple reached global banks like Barclays and Standard Chartered, each down over 5%.

- The Dow fell 410 points; S&P 500 and Nasdaq dropped nearly 1%.

The banking troubles triggered a wider confidence scare, spreading beyond the U.S. regional banking sector.

What’s Really Going On? The Hidden Web of Bad Loans

This isn’t isolated fraud — deeper structural risks are emerging across shadow banking, auto bankruptcies, and commercial real estate.

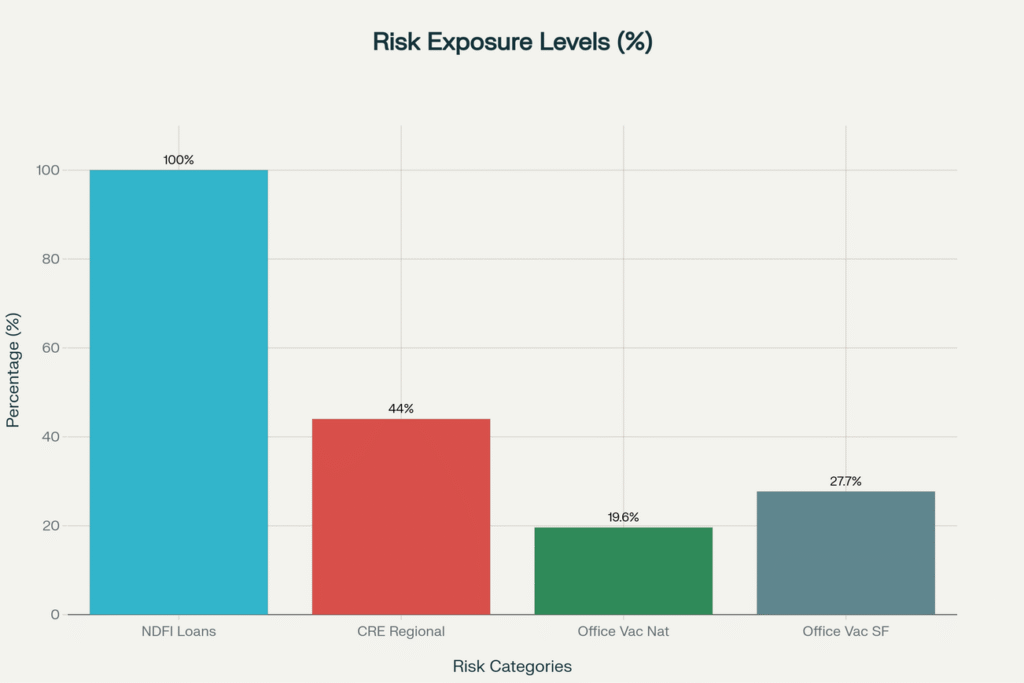

1. The NDFI Problem — “Shadow Banking” Exposed

- U.S. banks hold $1.14 trillion in loans to Non-Depository Financial Institutions (NDFIs), also known as shadow banks.

- This rapidly growing, lightly regulated sector saw loans jump 9.1% in just one quarter.

- Defaults here could be hard to trace and control, raising contagion fears.

2. Recent Bankruptcies — Auto Sector Pain

- Two major September bankruptcies raised alarm:

- First Brands Group, an auto-parts giant, filed for bankruptcy with $50 billion in liabilities and a DOJ probe into missing funds.

- Tricolor Holdings, a subprime auto lender, collapsed, costing JPMorgan $170 million.

- Other banks and investors such as Jefferies and UBS face hundreds of millions in potential losses.

- Jefferies’ stock plunged 22% after revealing exposure.

3. Commercial Real Estate — The Silent Weight

- Regional banks have nearly 44% of their portfolios tied to commercial real estate (CRE) loans.

- Office vacancies are at record highs: 19.6% nationwide and 27.7% in San Francisco.

- Over $1 trillion in CRE loans mature by the end of 2025, with refinancing under high interest rates posing risk.

Is This 2008 All Over Again?

Probably not—but it’s serious.

What’s Different This Time

- Stronger Banks: Capital ratios nearly 5× higher than pre-2008 levels.

- Equity-Rich Homeowners: Over 47% of U.S. homeowners have significant equity.

- Low Foreclosures: Current foreclosure rates at a low 0.13%.

- Tougher Lending Standards: Post-2008 regulations keep borrowers more qualified.

Why People Are Still Worried

- Jamie Dimon of JPMorgan warned, “When you see one cockroach, there are probably more.”

- Private credit markets worth $3-4 trillion globally have never faced a full recession test.

- Some banks’ exposure to opaque lending rivals their entire Tier 1 capital.

- U.S. total debt stands at $36 trillion, with consumer debt at $18.4 trillion, limiting the system’s margin for error.

What About Housing?

The housing market remains steady but not thriving.

The Good News

- The turmoil is mainly in commercial and corporate lending, not residential mortgages.

- Homeowner equity remains strong, cushioning against defaults.

- Most homeowners are locked into low mortgage rates, limiting supply growth.

Challenges Ahead

- Credit tightening means tougher mortgage approvals.

- Possible layoffs could increase delinquencies.

- Bank stress may hurt consumer spending and housing sentiment.

Mortgage rates hover near 6.7%, with prices expected to rise ~3% in 2025. The greatest barrier to home buying is affordability, not credit risk.

The Takeaway: Not a Crisis, But a Wake-Up Call

This isn’t another 2008 financial collapse — but it’s a warning.

Fraud, risky lending, and over-leverage are creeping back, especially in murky corners like shadow banks and CRE. The failures of First Brands, Tricolor, and the issues at Zions and Western Alliance show that even in a strong economy, pockets of risk can unravel quickly.

Banks are stronger, yet confidence remains fragile. Banking boils down to trust, and in uncertain times patience and diversification are the best strategies.

Stay informed, stay cautious, and watch carefully as the financial landscape evolves over the coming months.

Sources

This article is based on publicly available data and media reporting from the following sources:

- CNBC

- Reuters

- Bloomberg

- Financial Times

- CBRE (Commercial Real Estate research)

- Yahoo Finance

- Economic Times

- RTE (Irish news)

These sources collectively cover regional banks’ loan issues, shadow banking risks, auto sector bankruptcies, commercial real estate challenges, stock market impacts, comparisons with the 2008 crisis, and the housing market outlook as of October 2025. They represent reliable global financial news and market analysis outlets, providing the foundation for an informed and well-rounded article.

Disclaimer

This article is for informational purposes only. The information presented is based on publicly available data and third-party reports as listed above. While care has been taken to ensure accuracy at the time of writing, readers are strongly advised to do their own research and consult professional sources for the most accurate, up-to-date information. The author and publisher make no guarantees regarding the completeness or accuracy of the content provided.