Toronto’s Condo Meltdown: Why the Cloverdale Mall Project Could Change the City’s Housing Future

Toronto’s Condo Crisis: The Perfect Storm Threatening the Rental Market

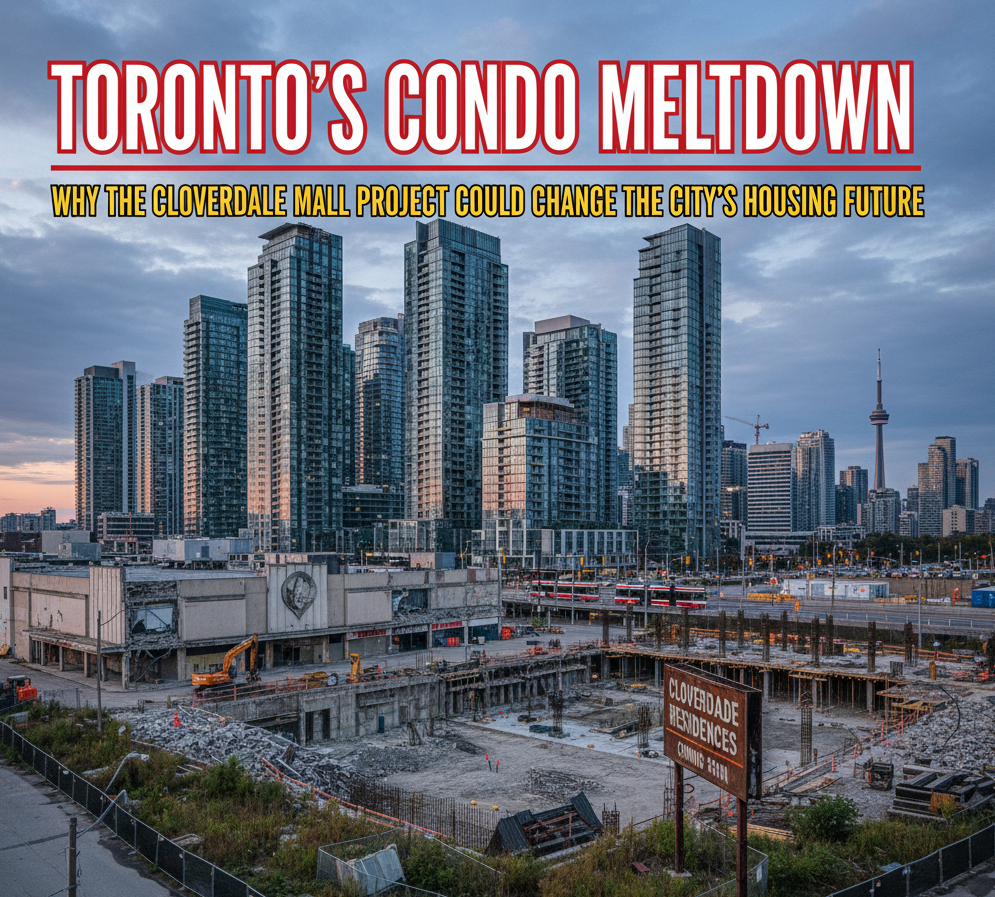

The recent cancellation of the Cloverdale Mall condo redevelopment project has exposed deep structural cracks in Toronto’s housing market. What may appear to be an isolated development setback is, in fact, part of a broader systemic crisis that’s reshaping both the ownership and rental landscapes across the Greater Toronto Area (GTA).

Industry data and expert analysis suggest this is the most severe market disruption in 35 years, setting the stage for a future housing shortage that could ripple through the rental market for years to come.

The Scale of the Crisis: Record Cancellations and Plummeting Sales

Toronto’s condo market in 2025 has entered uncharted territory.

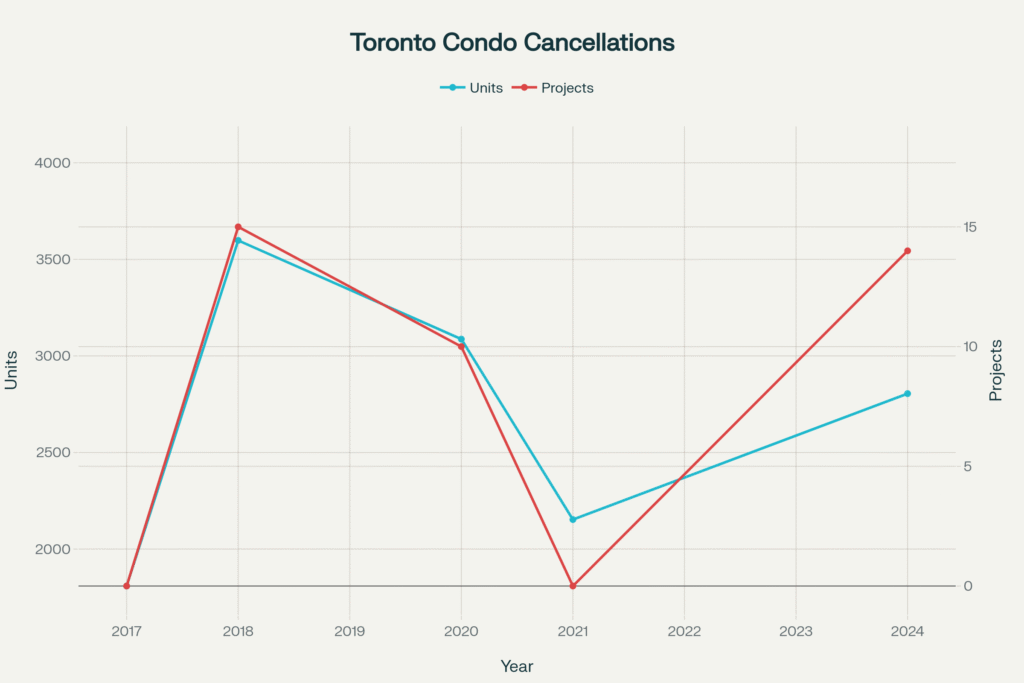

As of the third quarter, 18 condo projects totaling 4,040 units have been cancelled, surpassing the previous record set in 2018. Since the beginning of 2024, a total of 32 projects (6,981 units) have been scrapped, while another 20 projects—representing 4,187 units—are now in receivership or on indefinite hold.

The sales collapse has been equally dramatic. The Greater Toronto and Hamilton Area (GTHA) recorded just 319 new condo sales in Q3 2025—a 54% year-over-year drop and the lowest figure since 1990. This marks the worst year for sales in over three decades.

Why This Downturn Is Different

Unlike previous waves of cancellations caused by specific developer insolvencies, this crisis stems from fundamental market dysfunction—a combination of weak buyer demand, soaring construction costs, investor retreat, and tighter financing.

In past downturns:

- 2018 saw cancellations linked mainly to individual developers’ financial mismanagement.

- 2020 reflected temporary pandemic disruptions.

- 2025, however, represents a broad-based systemic failure, affecting the entire regional housing ecosystem.

Urbanation’s Michael Niezgoda notes that today’s cancellations “are more about overall market trends—there’s a lack of buyers and rising construction costs,” rather than developer incompetence.

The investor exodus has been particularly damaging. Investors—who once made up 40–50% of new condo buyers—are now retreating as higher interest rates, weaker rental yields, and mounting mortgage renewals erode profitability. Many are now facing negative cash flow, with rental income unable to cover ownership costs.

Short-Term Relief, Long-Term Pain for Renters

Temporary Relief (2024–2025)

Paradoxically, renters are currently enjoying modest relief:

- Vacancy rates have risen to 3.2–3.7%, the highest since 2021.

- Average rents fell about 2.2% year-over-year in early 2025, with some neighborhoods seeing declines of up to 10%.

- Landlord incentives have surged, with 63% of rental buildings offering deals such as one or two months of free rent.

- New rental completions have spiked, up 77% in the first half of 2025 compared to last year.

Looming Supply Cliff (2026–2028)

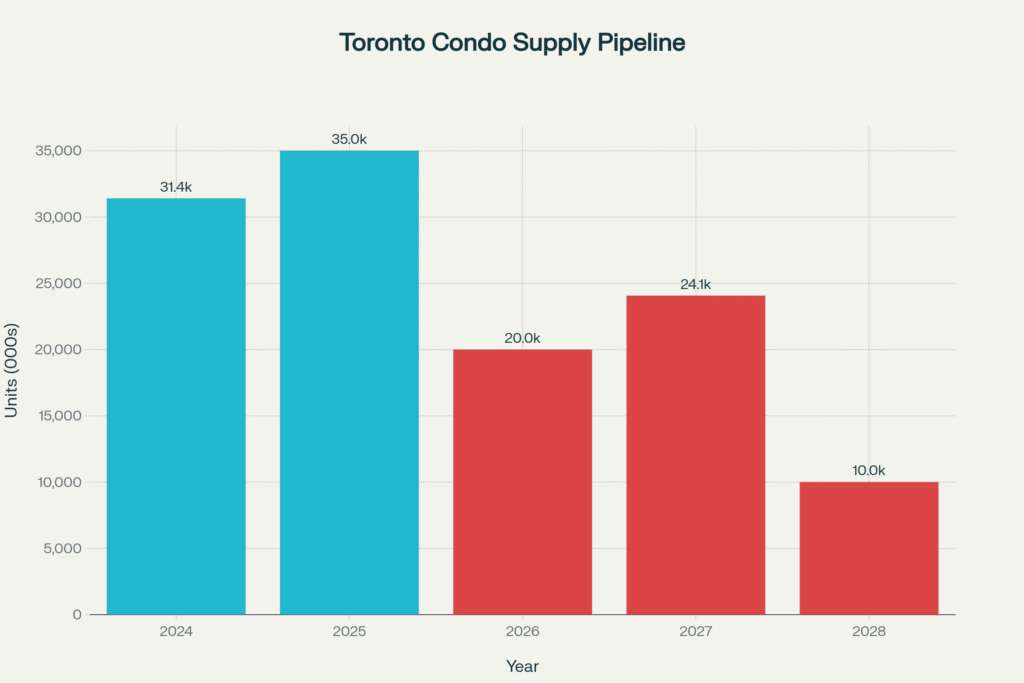

However, this relief is likely short-lived. Behind the scenes, condo construction starts have collapsed—dropping 79–88% below historical averages. By 2028, Toronto is expected to deliver fewer than 10,000 new units annually—the lowest level in decades.

RBC Economics warns that Ontario’s housing pipeline will likely “taper out by 2026,” creating severe shortages in the years ahead.

The Coming Rental Market Crunch

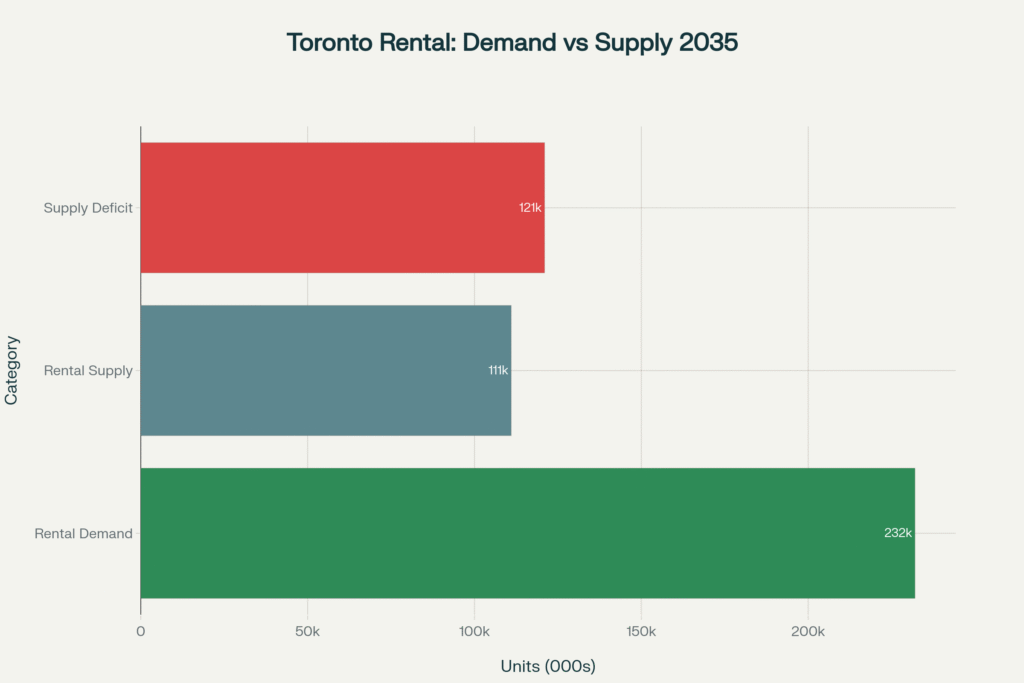

Over the next decade, Toronto faces a projected rental housing deficit of 235,000 units.

Historically, about half of newly built condos enter the rental pool, but with condo development stalling, that critical source of supply is drying up. Purpose-built rentals, meanwhile, remain far below what’s needed—construction would need to triple to meet future demand.

As completions drop after 2025, rents are expected to rebound sharply by 2027–2028, reversing the temporary declines seen today.

Why More People Are Renting Longer

Several structural factors are keeping people in the rental market:

- Affordability: Condo prices, while down 12% from 2023 peaks, remain unaffordable for many buyers.

- High interest rates: Mortgage payments are up by $800–$1,000 monthly compared to pandemic-era lows.

- Investor retreat: Many units once rented by investors are being sold off.

- Job market weakness: Toronto’s youth unemployment rate remains over 14%, keeping many potential buyers sidelined.

Expert Warnings: A Systemic Breakdown

Economists and housing analysts agree that Toronto’s current condo meltdown is a system-wide failure, not a series of isolated incidents.

BMO economist Robert Kavcic cautions, “We are still in the early stages of the condo market adjustment,” adding that the downturn “will unfold over several years rather than months.”

Similarly, CMHC has warned that “the projects cancelled today mean fewer housing completions tomorrow,” warning that the current relief in rents will give way to a deeper affordability crisis later in the decade.

The Verdict: Today’s Relief, Tomorrow’s Crisis

Toronto is now facing a paradox: temporary rental relief in 2025 will likely evolve into an acute housing shortage by 2027–2028.

As Urbanation President Shaun Hildebrand explains, “The lack of activity occurring today will surely lead to a lack of supply in a couple years, helping to restart the engine for the market—but at the cost of renters facing that scarcity.”

The Cloverdale Mall condo cancellation is not just a failed development—it’s a warning signal of the most severe housing market failure in Toronto’s modern history, with effects that could last a decade.

Sources

This article is based on publicly available data and media reporting from the following sources:

- The Globe and Mail

- Global News

- Urbanation

- CMHC

- Storeys Media

- BMO Economics

- RBC Economics

- Liv Rent

- Rental.ca

- Original reporting also draws from insights discussed in the YouTube video by Toronto Real Estate Insider, titled “Toronto Condo Collapse 2025: What’s Really Going On?” (YouTube Link).

Disclaimer

This article is for informational purposes only. The information presented is based on publicly available data and third-party reports as listed above. While care has been taken to ensure accuracy at the time of writing, readers are strongly advised to do their own research and consult professional sources for the most accurate, up-to-date information. The author and publisher make no guarantees regarding the completeness or accuracy of the content provided.